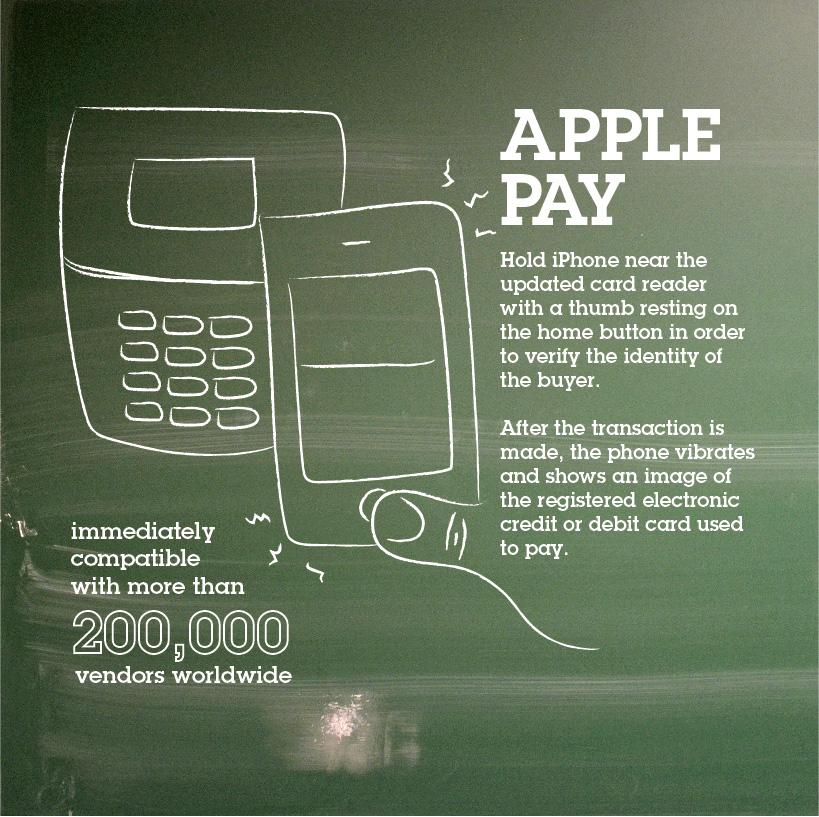

At the time of the launch, the new feature was immediately compatible with more than 200,000 vendors worldwide, including stores such as Macy’s, Whole Foods, American Eagle Outfitters, Target, Walgreen’s, Panera Bread, Subway and McDonald’s. Apple Pay will work with Visa, MasterCard and American Express cards.

Now, the technology has come to Tuscaloosa.

“Over a year ago we got the wireless boxes that allow you to pay with your phone,” said Stephen Eviston, assistant manager at Tuscaloosa’s McDonald’s on 15th Street. “These boxes are also compatible with Google’s Mobile Wallet and now with Apple Pay as well.”

Apple Pay works by holding an iPhone or compatible device near the updated card reader with a thumb resting on the home button to verify the identity of the buyer. After the transaction is made, the phone vibrates and shows an image of the registered electronic credit or debit card used to pay.

“The concept is good, but I would question the safety of the service because a credit card number isn’t something you expose to the web,” said Michael Gandra, a junior majoring in chemical engineering. “However, Apple is always bringing innovation, and I think Apple Pay is something that will be around for some time.”

The service was announced by Apple CEO Tim Cook at the release of the iPhone 6 Sept. 9 and was described as an “easy, secure and private way to check out.” According to Business Insider, the main purpose of the app is to turn a mobile device into a wallet with a simple update to the operating system, iOS 8.1.

Bank of America, CITI, American Express, Wells Fargo, Capital One and Chase are the participating banks that are compatible with Apple Pay so far. Barclaycard, Navy Federal Credit Union, PNC, USAA and US Bank will add Apple Pay to their services later this year.

With Apple Pay, a unique device account number is assigned and safely stored in a chip called Secure Element, included in the new iPhone, iPad and Apple Watch. According to Apple, this DAN is never stored in Apple servers, making it difficult for hackers to steal credit or debit card information. In other words, Apple never keeps the transaction information.

“The concept of Apple Pay has the potential to become the future of checking out, because nowadays we use one device to do everything: listen to music, take pictures, make calls, organize information, surf the web and now make payments,” said Tori Vines, a sophomore majoring in advertising. “These multitask devices make it more convenient and practical to carry out different activities, and people are looking for that easiness.”

Apple Pay has the ability to add multiple credit cards to a virtual wallet, and by snapping a photo of the card it automatically fills in the card numbers and expiration date with no need of typing the information in manually.

Eviston said an average of four people use the electronic payment service available at the McDonald’s branch and since Apple Pay was released three weeks ago, approximately nine costumers have used it so far.

“Since it just came out, I think it will be a matter of time for it to become popular,” Eviston said.